arkansas estate tax return

Find Reliable Business Tax Info Online in Minutes. Estate taxes are one of the oldest forms of taxation and are among the largest sources of federal tax revenue.

However if you are inheriting property from another state that state may have an estate tax that applies.

. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. Your Arkansasgov Governor Asa Hutchinson. The Arkansas Department of Finance and Administration handles all state tax issues.

Online payments are available for most counties. Ad 247 Access to Reliable Income Tax Info. You will also likely have to file some taxes on behalf of the deceased.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. When you die there are many federal and estate tax situations that need to become a priority for those.

AR1002NR Non-Resident Fiduciary Income Tax Return. Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. Box 2144 Little Rock AR 72201-2144.

AR1000TC Schedule of Tax Credits and Business Incentive Credits. Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete Individual Partnership. Be sure to pay before then to avoid late penalties.

Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Arkansas State Income Tax.

Other Necessary Tax Filings. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals. Learn about Arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return.

In the case of the estate of a resident or a nonresident who dies having real property andor tangible personal property located in a state other than Arkansas the Arkansas tax due shall be a percentage of the Federal Credit Allowable for State Death Taxes in the same proportion which. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face. How to reduce the taxable part of an estate in Arkansas.

This tax is item 5b on the Arkansas Estate Tax Return Form. AR1002-TC Fiduciary Schedule of Tax Credits and Business Incentive Credits. Check the status of your Arkansas Income Tax return.

Continue your conversation over the web email or SMS. Contact our law office at 262-237-8668. Pay-by-Phone IVR 1-866-257-2055.

Arkansas state income tax rates range from 0 to 59. AR4FID Fiduciary Interest and Dividends. The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual Partnership Fiduciary and Limited Liability Company tax codes and regulations.

Personal Property - Under Arkansas law ACA. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Unlike a gift tax the estate tax only applies to estates that are worth more than one million dollars.

Our Kenosha tax lawyer assists fiduciaries with filing income tax returns for an estate or trust and paying taxes. Box 1000 Little Rock AR 72201-1000. Citizen or resident and decedents death occurred in 2016 an estate tax return Form 706 must be filed if the gross estate of the decedent increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than the filing.

For people expecting a refund they can mail the return to Arkansas State Income Tax PO. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. Chat with a Business Tax Advisor Now.

Find My Representative. The statewide property tax deadline is October 15. If the decedent is a US.

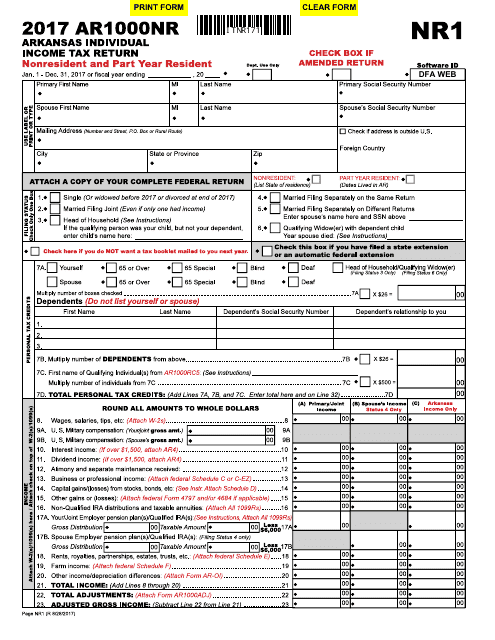

26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar property at the. AR1000NR Part Year or Non-Resident Individual Income Tax Return. AR1000-OD Organ Donor Donation.

Calling the DFA or its tax hotline at 1-501-682-1100 or 1-800-882-9275. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Emailing IndividualIncomedfaarkansasgov with your queries.

AR1002F Fiduciary Income Tax Return. These additional measures may result in tax refunds not being issued as quickly as in past years. The association may file the form that results in the lowest taxa receiver trustee or assignee the fiduciary must sign the return.

This page contains basic information to help you. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. Talk to Certified Business Tax Experts Online.

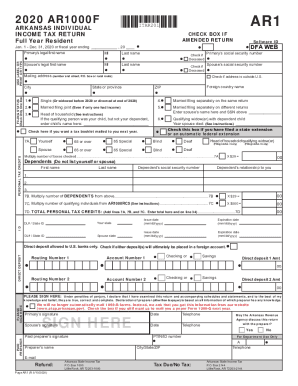

AR1000F Full Year Resident Individual Income Tax Return. IDENTIFICATION Date of Death Decedents SSN Estate Tax Return Due Date Decedents First Name and Middle Initial Decedents Last Name. Arkansas does not collect an estate tax or an inheritance tax.

One 1 copy of the approved request must be attached to the return when filed. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. Go to Income Tax Refund Inquiry.

Your Arkansasgov Governor Asa Hutchinson. Get instant answers to hundreds of questions about government services. Arkansas Estate and Inheritance Tax Return Engagement Letter - 706 FAQ Is Form 706 required.

However some people opt to pass on assets to their heirs in order to avoid the estate tax. There are two kinds of taxes owed by an estate. AR1000RC5 Individuals With Developmental Disabilites Certificate.

The 2021 Arkansas State Income Tax Return forms for Tax Year 2021 Jan. For questions about individual state income tax there are a few ways you can get help. For those paying taxes or who do not expect a refund nor need to pay taxes they can mail their return to Arkansas State Income Tax PO.

Get instant answers to hundreds of questions about government services. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. Continue your conversation over the web email or SMS.

Check your refund status at. Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files. Market Value - ACA.

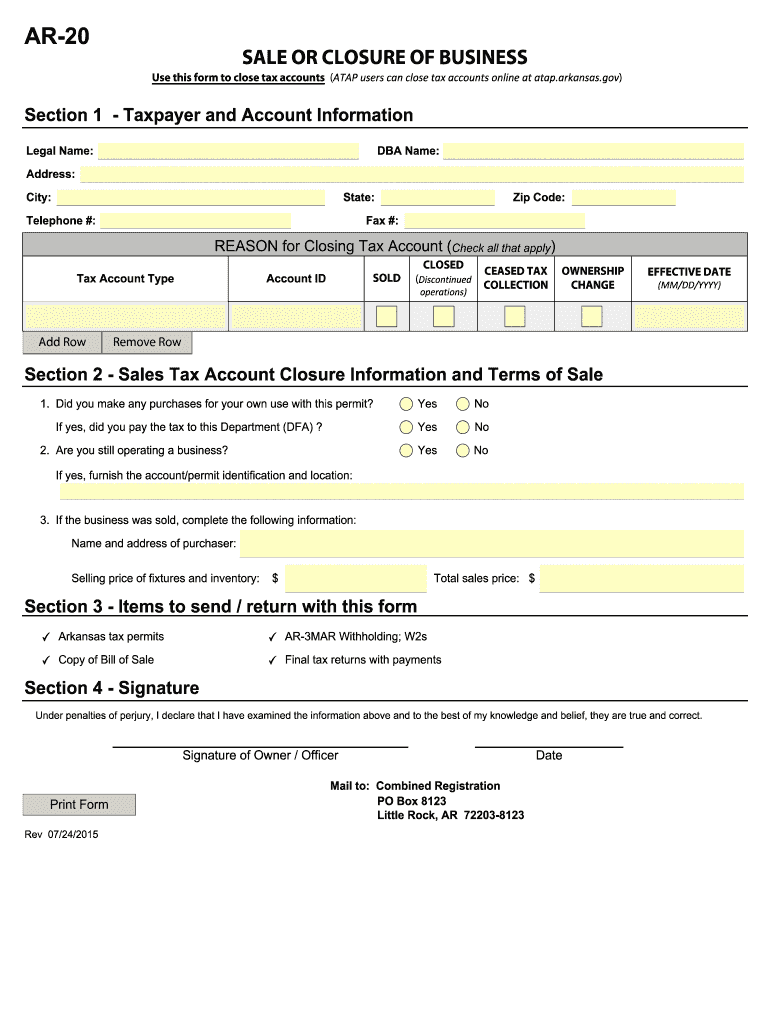

Ar Ar 20 2015 2022 Fill Out Tax Template Online Us Legal Forms

Free Arkansas Special Warranty Deed Form Pdf Word Eforms

Arkansas State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Form Ar1000nr Download Fillable Pdf Or Fill Online Arkansas Individual Income Tax Return Nonresident And Part Year Resident 2017 Arkansas Templateroller

Filing An Arkansas State Tax Return Things To Know Credit Karma

30 Day Notice To Vacate Pdf Rental Property Management Real Estate Management Real Estate Investing Rental Property

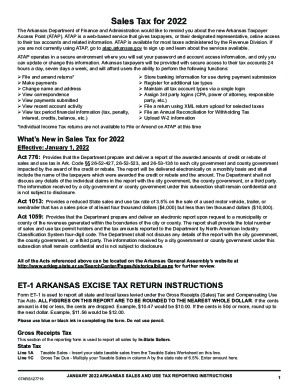

Et 1 Form Arkansas Fill Online Printable Fillable Blank Pdffiller

Arkansas State 2022 Taxes Forbes Advisor

Fifty Factory Tours That Make America Great

Arkansas Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Arkansas State Tax Information Support

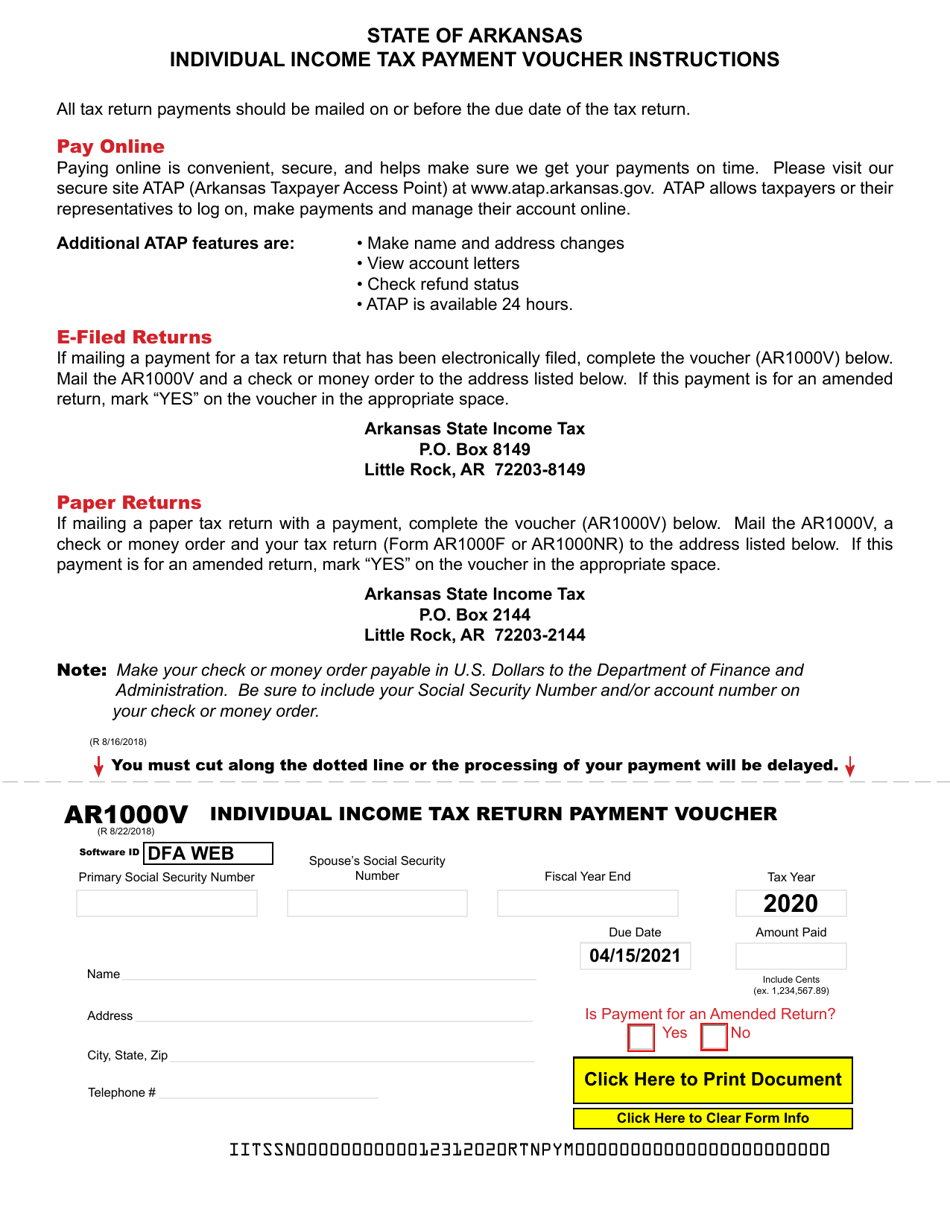

Form Ar1000v Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Voucher 2020 Arkansas Templateroller

The Ultimate Guide To Arkansas Real Estate Taxes

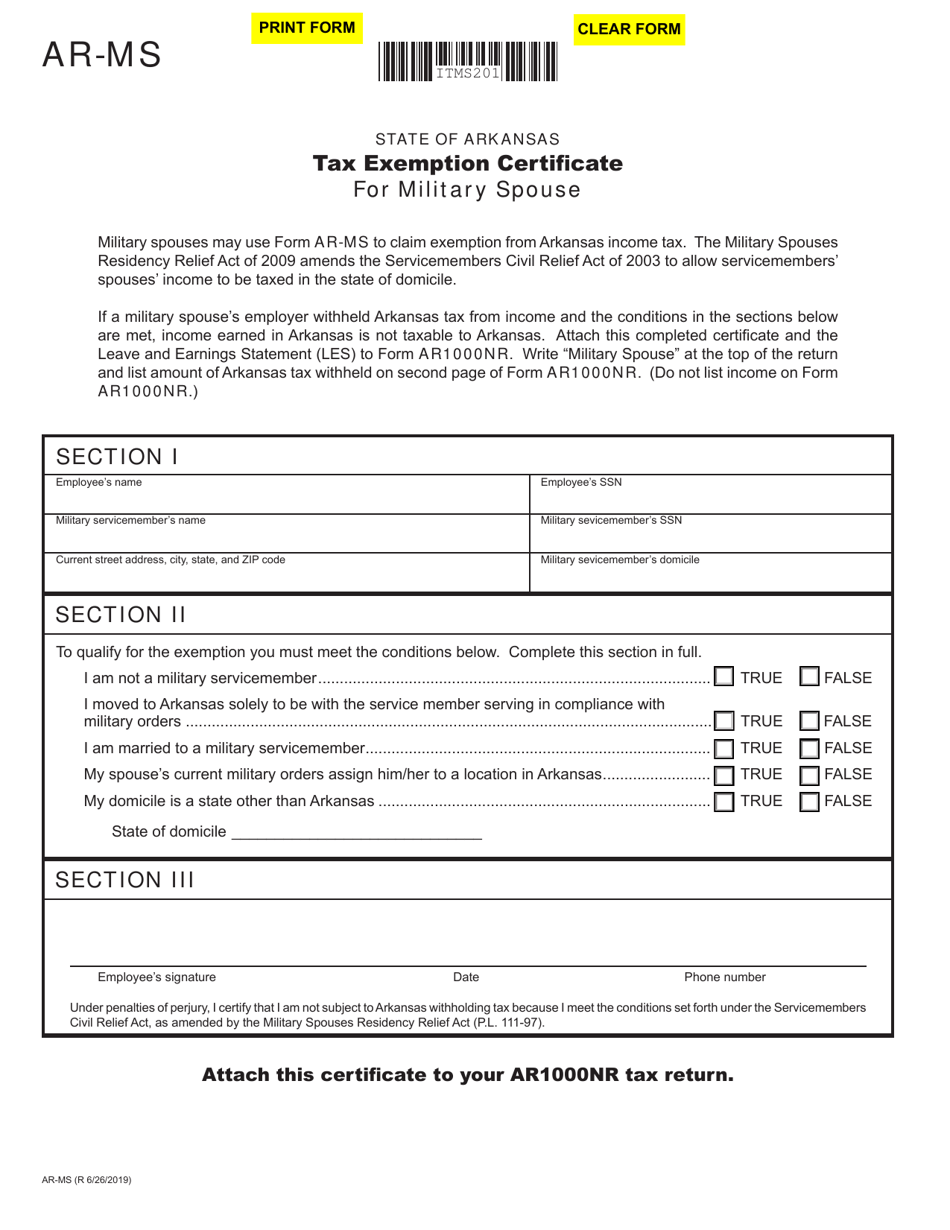

Form Ar Ms Download Fillable Pdf Or Fill Online Tax Exemption Certificate For Military Spouse Arkansas Templateroller

Is There An Inheritance Tax In Arkansas

Irs Arkansas Tax Form Ar1000adj Pdffiller

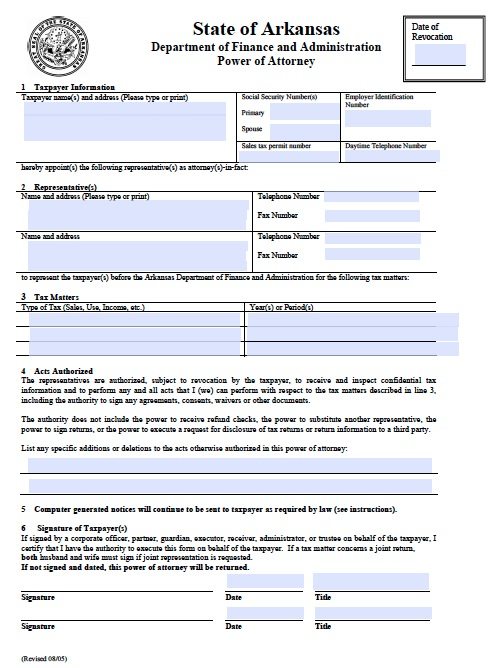

Free Arkansas Tax Power Of Attorney Form Pdf Eforms

Free Tax Power Of Attorney Arkansas Form Fillable Pdf

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact